To extend the time to file taxes, you'll need to file Form 1138, which you can get from the IRS. Form 4868 is an IRS supplementary form to apply for an extension of time, not an extension to pay taxes. If my tax extension is approved, does that mean I won't owe the IRS money in April? No. Sole proprietorships and single-member LLCs are given an extended due date of October 15, 2010. I was approved, when is my extended tax return due? For Corporations, multi-member LLCs and partnerships operating on the calendar year for tax purposes are given an extended tax deadline of September 15, 2010. Then you can come back here and resubmit. If you get rejected, we'll tell you why and help you resolve the issue. We'll send you an email with the results as soon as we get them. How long will it take to get approved? Just a few days. citizen or resident) to file Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ." When is Form 4868 due? You need to get it transmitted by midnight on April 15 in your time zone. What is the purpose of Form 4868? According to the IRS, you, "Use Form 4868 to apply for 6 more months (if “out of the country” and a U.S. But you can avoid that altogether by E file Form 4868. If you can show reasonable cause, you may not have to pay the late filing fee. For returns filed 60 days or later, the minimum penalty is $135 or the balance of the tax dues, whichever is smaller. A late filing penalty, usually 5% of the amount due for each month or part of a month the return is late, is charged if your return is filed after the due date. You will owe the interest regardless of the reason for paying late. If you owe any tax and fail to pay it by the regular due date, even if you did file an extension, interest will be assessed until you pay the tax. Should you fail to file your return or pay any tax due by the deadline, you may incur penalties and/or interest. Once you have filed IRS Form 4868, you can file your tax return at any time before the Tax extension expires. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) Income Tax Return for residents of Puerto Rico Income Tax Return for Certain Nonresident Aliens With No Dependents U.S. Income Tax Return for Single and Joint Filers With No Dependent U.S. Individual Income Tax Return Annual income tax returns filed by citizens and residents of the United States. Remember, this doesn't extend the time for payment if you owe anything to the IRS.Īccording to the IRS, you, "Use Form 4868 to apply for 6 more months (if “out of the country” and a U.S.

The IRS will grant you an extra six months to file your new deadline will be October 15. If you don't think you'll be able to hit that dreaded April 15 deadline, you can get an extension easily by efiling IRS Form 4868.

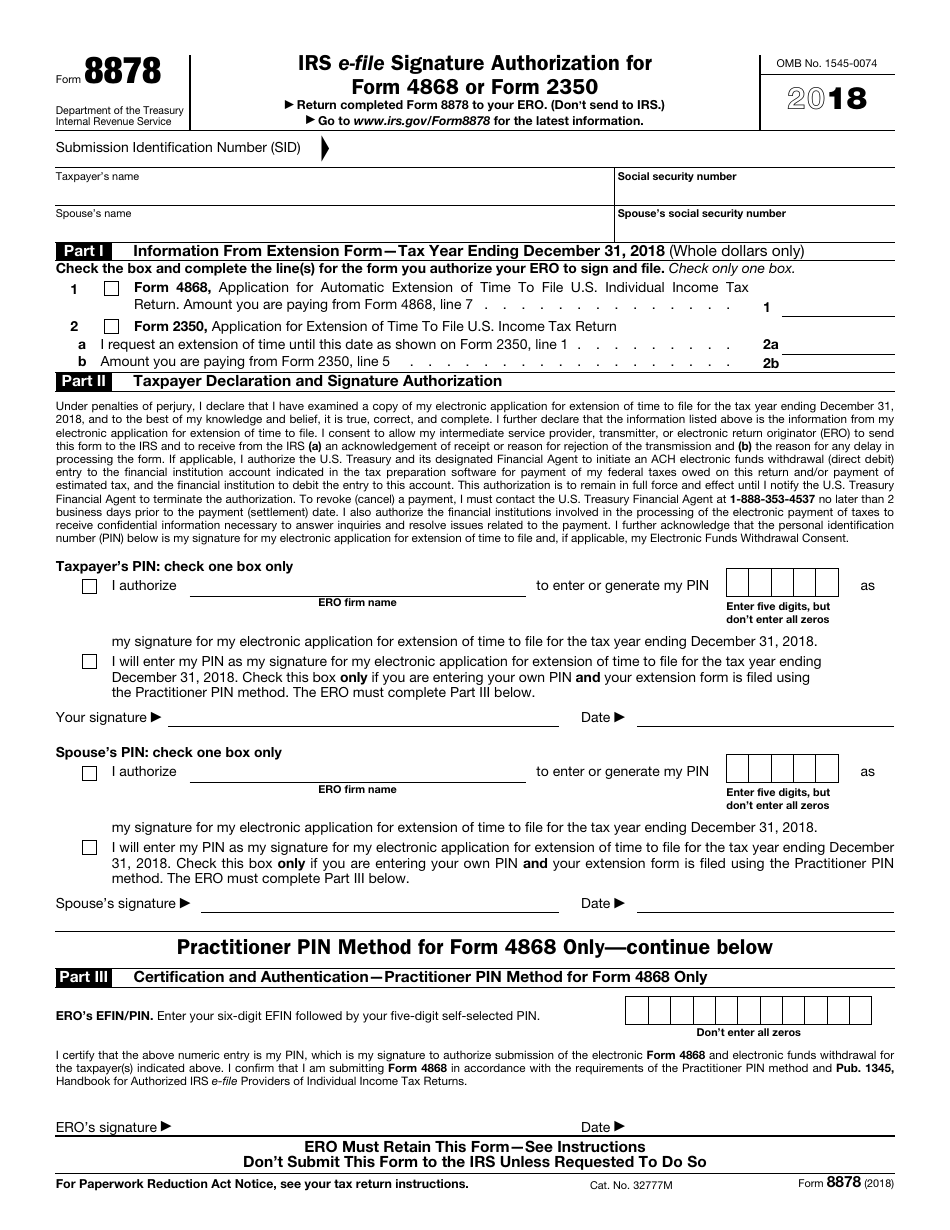

Here the Topic about IRS Form 4868.Ī personal tax extension uses Form 4868, officially called an Application forĪutomatic Extension of Time to File U.S. Nonprofits can file the IRS Form 8868 for an automatic 3 month extension, followed by an additional 3 month extension if needed. Non Profit organizations are not exempt from being able to file this form either. For individuals that need a tax extension, they can use the IRS Form 4868 for a 6 month extension. The IRS Form 7004 can be filed for businesses wishing to extend their tax return deadline. There are several forms that can be filed for this.

The IRS is now accepting this online through E-Filing. Filing a Tax Extension with the IRS can delay your tax return deadline by up to 6 months. Tax extensions are IRS supplementary forms to apply for an extension of time, not an extension to pay taxes. The IRS will still expect to receive the estimated tax amount upon the deadline. It does not extend the amount of time to pay the taxes due. An IRS tax extension is meant to extend the amount of time that a person has to file a return. If additional time is needed to file a tax return with the IRS.

0 kommentar(er)

0 kommentar(er)